Why You Need to Know About Credit Reports & Credit Scores

Having good credit and using it wisely is more important than ever these days. Fortunately, it is also easier than ever to monitor your credit files and to correct errors that could have a negative impact on your credit rating thanks to a series of new laws designed to protect you, the consumer, in your use of credit, credit cards and the credit system.

The Importance of A Good Credit Report

Your individual credit report is an important barometer of your overall financial health. This summary of your financial reliability—prepared by credit bureaus (also called credit reporting agencies)—tells lenders about your history of paying bills and is used by them to decide whether to loan you money and at what rates and terms.

Your credit report is compiled from information lenders supply to the credit bureaus. It has four parts:

-

- Identifying information.

- Public record information…to determine if you have previous defaults or legal judgments against you.

- Credit history information…such as a list of your credit cards and loans and whether payments were on time.

- Inquiries…a section that lists the creditors or other parties that have requested your credit report.

Obtaining a Copy of Your Report Is Free

Typically, there is no single credit report. Most likely, each of the three major nationwide credit bureaus—Equifax, Experian and TransUnion—have a credit report on you. And because the credit bureaus may collect and report different information, many experts advise you to obtain your report from each. Under federal law, you are entitled to obtain a free copy of your credit report once a week from each of the three major credit bureaus (Equifax, Experian and TransUnion). It is especially important to review your credit report before making a major purchase so you can correct an error before it slows down your credit approval or prevents you from getting the best possible loan terms. Your free weekly credit reports are available through April 2021.

Obtain a free credit report by visiting www.annualcreditreport.com or call 877.322.8228

What to Look for, When to Act

With your report in hand, closely review these key areas:

-

- Timeliness—If it shows late payments, but you always pay your bills on time, correct the error immediately.

- Accounts—Make sure all the accounts are yours. Identity thieves often open accounts in your name using stolen information, and they will often show up here.

- Dormant Accounts—If you notice accounts you no longer use, it might be wise to close them. They could be affecting your credit score.

- Credit Score—If the report does not include your credit score, ask for it. There may be a charge. A free credit score is not included in your free credit report.

Correcting Wrong or Incomplete Information

-

- Identify each item in your credit report that you dispute.

- Immediately tell the credit bureau, in writing. Federal law requires credit bureaus to investigate your complaint (generally within 30 days), send you a prompt response and correct any errors.

- Contact the company that provided the inaccurate or incomplete information and request a correction of its records, too.

If a credit bureau’s investigation does not resolve your concerns, the law allows you to submit a brief statement about the matter that must be attached to your credit report and provided to anyone that accesses your report in the future.

The Importance of Your Credit Score

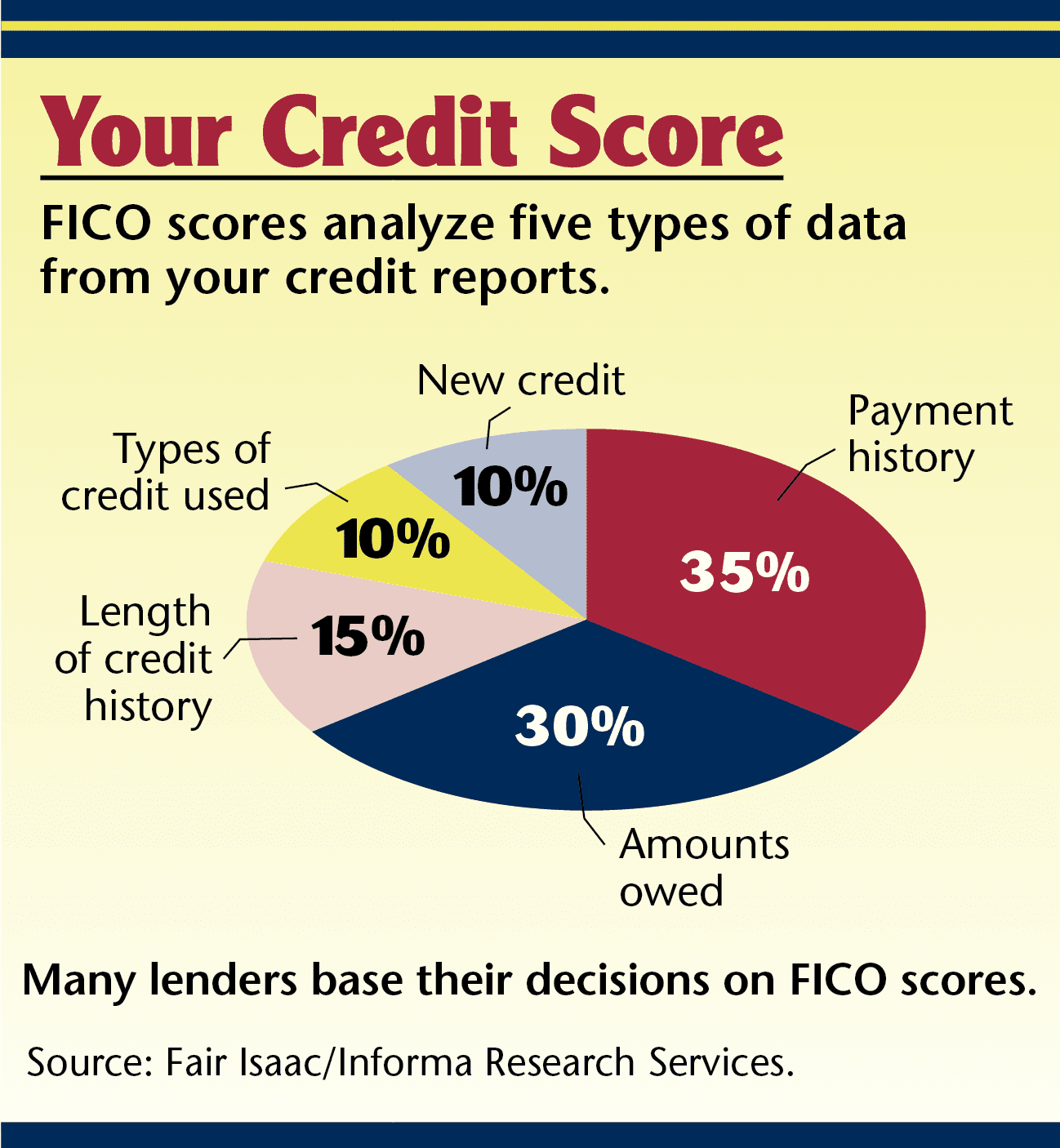

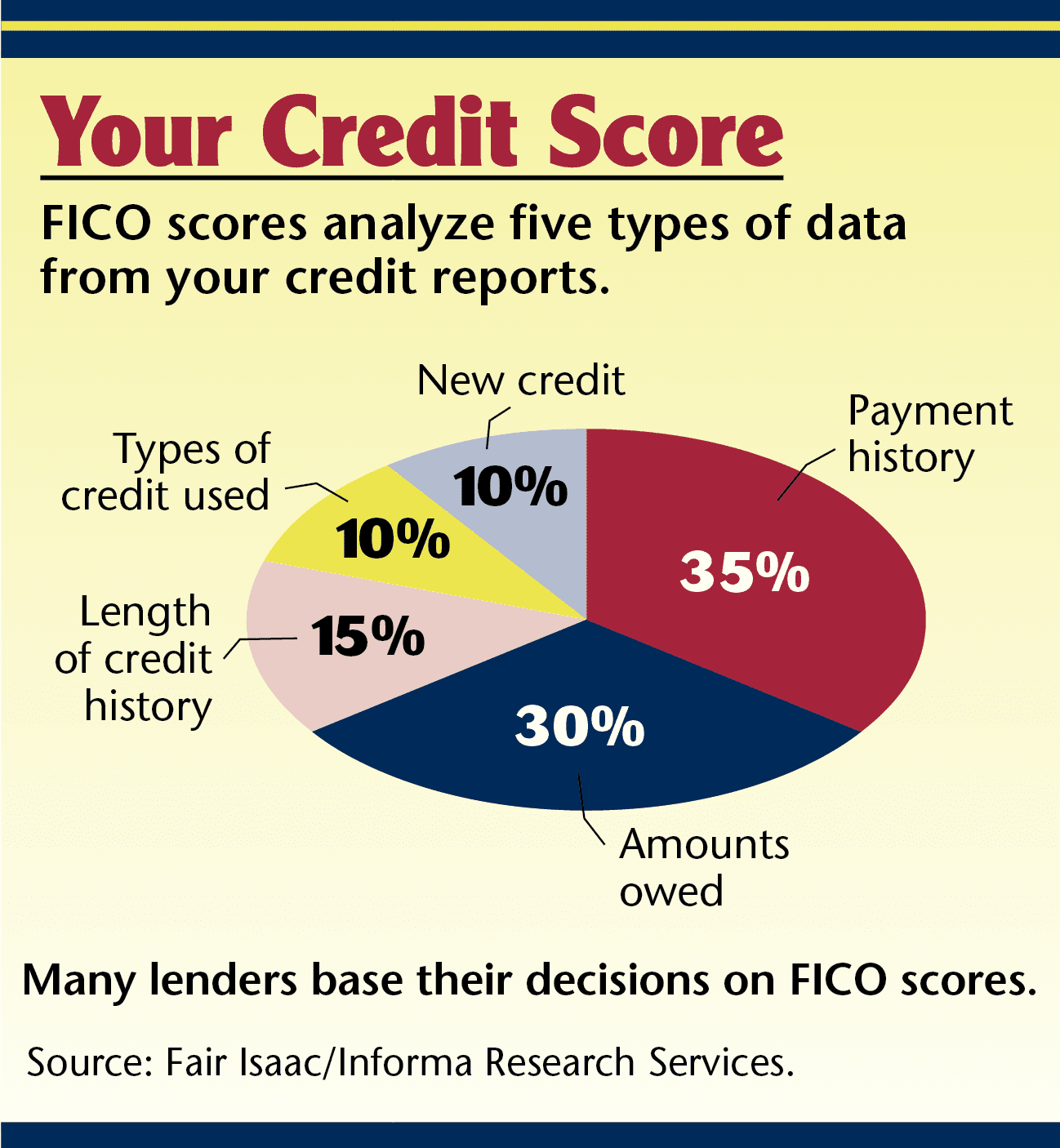

A credit score is a number used by lenders to make a decision on a loan or other credit. Many lenders use a system developed by Fair Isaac and Company called the FICO score—a point system based on your credit history to predict creditworthiness (see chart). Your credit score is most influenced by

-

- Your payment history

- The amount of your debt

Late payments, a past bankruptcy, debt collections, or a court judgment ordering you to pay money as a result of a lawsuit will negatively affect your credit score. Too much debt relative to your income is also a warning sign to creditors and will usually lower your score. In general, the better your credit score, the better your chances of getting credit with an attractive interest rate. Since your credit score is highly dependent on your credit report, it is critical that your credit report is accurate. Your score, along with an explanation of how the score was derived, is available from any of the three major credit bureaus usually for a fee. Each bureau may have different information about you, so your score may vary from one company to another.

Your Legal Protections

Federal law (The Fair Credit Reporting Act) provides a “bill of rights” for consumers’ credit records—your right to ask for your credit score…to know when information in your file is used against you…to dispute incomplete or inaccurate information and to have it corrected…to restricted access to your report (including employers, who must have your explicit permission)….and to seek damages in specific instances.

Fraud Alerts: A “Fraud Alert” can be placed on your credit file. A Fraud Alert helps prevent anyone from opening new accounts in your name, acting as a red flag on your credit report, visible only when businesses access your file to possibly extend you credit. To place an alert on your account, call one of the three credit reporting agencies and ask them to flag your credit file for fraud. An alert will be attached to your credit file and your name will be removed from pre-approved credit and insurance applications for two years.

Initial Alert: An “Initial Alert” will be active on your credit report for 90 days. Use this if someone has gained access to personal information that could be used to open accounts in your names, such as your Social Security number, or a credit account number. Once an initial alert is in place, potential creditors will need to verify your identity prior to extending credit, so you should provide them with a phone number where you can be easily reached.

Extended Alert: An “Extended Alert” is recommended if your identity has been stolen. With an extended alert, your credit file will remain guarded for seven years. In addition, your name will be removed from lists marketing prescreened credit offers for five years.

Military Fraud Alert: Members of the military on active duty are eligible for a “Military Fraud Alert.” This alert allows members of the military to prevent anyone from opening accounts in their name while they are deployed.

Credit Freeze: Take action to protect your personal financial security. Place a credit freeze on your accounts by calling each of the three nationwide credit bureaus to restrict access to your credit report. If you want a business, lender, or employer to review your credit report, then upon your request, the credit bureau will lift the freeze either temporarily or permanently at no charge to you. Companies that had access to your report prior to the credit freeze will still have access to the reports.

Victims of Identity Theft Have Additional Rights

You have specific rights when you believe that you are the victim of identity theft:

-

- You can ask the nationwide credit agencies to place “fraud alerts” in your file (see above).

- You have the right to free copies of the information in your file.

- You can request and obtain documents relating to fraudulent transactions made or accounts opened using your personal information.

- If you believe the information in your files is the result of identity theft, you can request that the consumer reporting agency block that information from your file.

Learn more about credit reporting agencies:

www.equifax.com 800.685.1111

www.experian.com 888.397.3742

www.transunion.com 800.888.4213

For more information visit: www.ftc.gov/credit.

As a small business owner, you wear a lot of hats and juggle many different responsibilities. But above anything else on your plate, you know it’s imperative customers pay you on time. You need cash flow to manage your business, pay your debt and invest in your growth.

As a small business owner, you wear a lot of hats and juggle many different responsibilities. But above anything else on your plate, you know it’s imperative customers pay you on time. You need cash flow to manage your business, pay your debt and invest in your growth.